Discover the Best Wyoming Credit Unions: Your Overview to Citizen Financial Services

Discover the Best Wyoming Credit Unions: Your Overview to Citizen Financial Services

Blog Article

Why Credit Report Unions Are the Secret to Financial Success

In today's intricate financial landscape, people look for dependable organizations that can provide greater than simply basic banking services. Credit history unions have actually become an engaging choice for those aiming to improve their economic wellness. With a focus on community-driven efforts and tailored remedies, cooperative credit union stick out as key gamers in cultivating monetary success. The inquiry continues to be: Exactly how do these organizations genuinely establish themselves apart and lead the means for people to attain their financial goals? Let's check out the special benefits that credit rating unions bring to the table, reshaping the traditional banking experience right.

Benefits of Joining a Lending Institution

Joining a debt union uses various benefits that can favorably influence one's financial health. Unlike standard financial institutions, credit rating unions are member-owned cooperatives, which suggests that each member has a voice in how the union operates.

In addition, cooperative credit union often supply far better client service than larger monetary establishments. Members frequently report higher contentment degrees due to the tailored interest they receive. This dedication to member solution can result in tailored financial solutions, such as personalized financing alternatives or financial education and learning programs, to assist members attain their monetary objectives.

Furthermore, belonging of a lending institution can use access to a range of economic items and solutions, frequently at more competitive prices and with reduced costs than traditional banks. This can lead to cost savings over time and add to overall financial security.

Affordable Prices and Reduced Fees

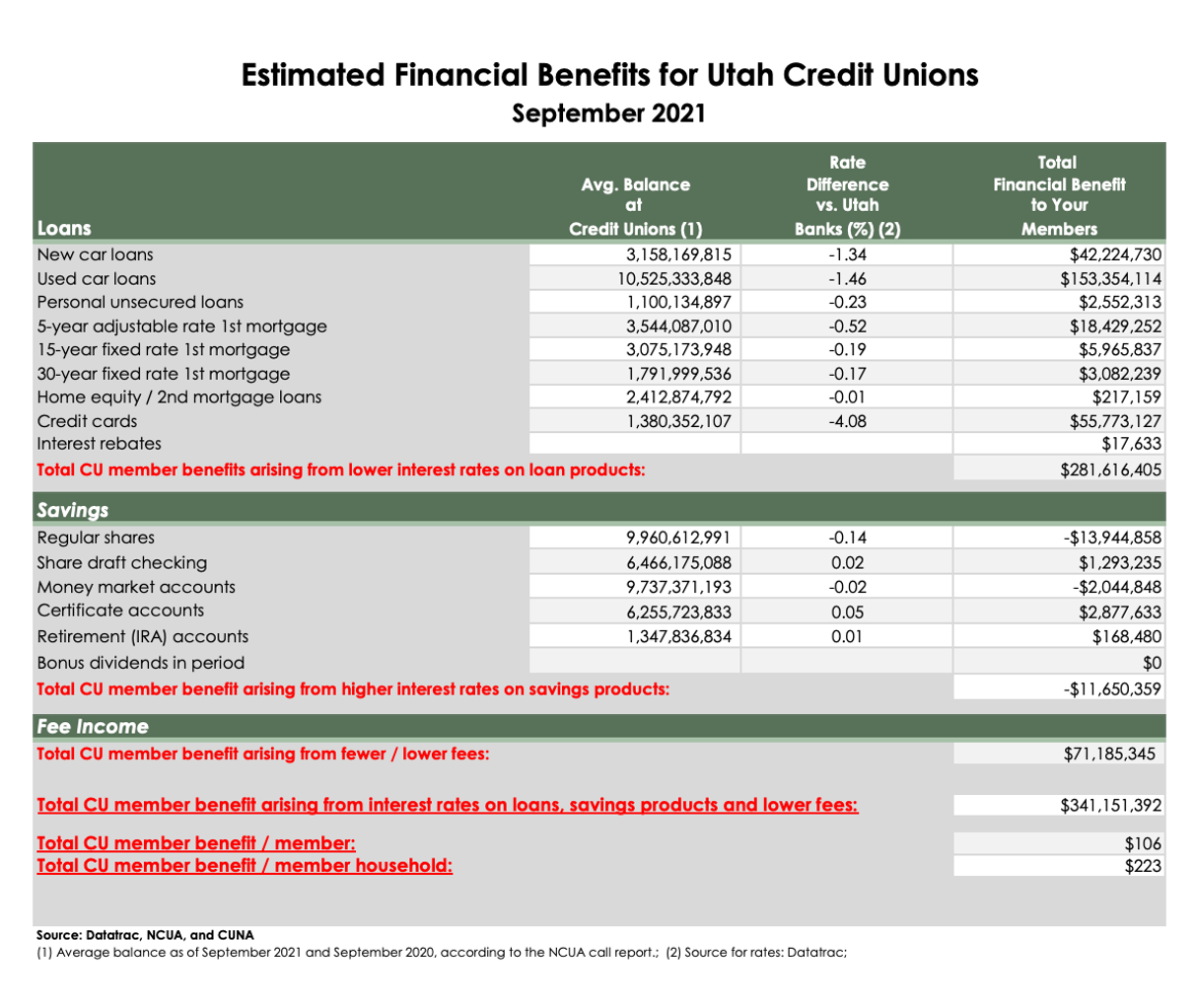

Lending institution are recognized for supplying competitive prices and lower fees contrasted to traditional banks, giving members with cost-efficient monetary services. One of the crucial benefits of lending institution is their not-for-profit standing, allowing them to prioritize participant advantages over making the most of revenues. This difference in structure often converts right into much better rate of interest on interest-bearing accounts, reduced interest prices on financings, and reduced costs for numerous services.

Personalized Financial Solutions

With a focus on meeting specific economic requirements, cooperative credit union master offering customized economic services customized to enhance member complete satisfaction and monetary success. Unlike typical banks, lending institution focus on recognizing their members' distinct economic circumstances to provide tailored solutions. This personalized strategy allows lending institution to provide a variety of solutions such as personalized monetary advice, customized financing options, and customized cost savings plans.

Members of credit scores unions can benefit from customized financial services in various methods. Furthermore, credit scores unions provide customized financial suggestions to help members achieve their financial objectives, whether it's saving for a significant acquisition, preparing for retirement, or enhancing credit score scores.

Area Support and Interaction

Emphasizing civic involvement and fostering interconnectedness, credit unions proactively add to their areas with robust support initiatives and meaningful engagement programs. Area support is at the core of lending institution' values, driving them to surpass just financial solutions. These organizations commonly participate and arrange in numerous regional events, charity drives, and volunteer activities to return and strengthen the neighborhoods they serve.

One means cooperative credit union demonstrate their commitment to community assistance is by providing financial education and proficiency programs. By supplying resources and workshops on budgeting, conserving, and investing, they equip individuals to make enlightened monetary choices, inevitably adding to the total well-being of the neighborhood.

Furthermore, lending institution often partner with regional companies, colleges, and not-for-profit organizations to resolve particular area requirements. Whether it's sustaining local business through loaning programs or sponsoring instructional efforts, cooperative credit union play a crucial role in driving positive modification and cultivating a sense of belonging within their neighborhoods. Via these collective initiatives, cooperative credit union not just enhance monetary learn this here now success yet likewise grow an even more resilient and inclusive society.

Building a Solid Financial Structure

Developing a strong financial base is important for lasting prosperity and stability in individual and organization finances. Developing a solid financial foundation includes a number of crucial parts. The very first step is producing a realistic budget that describes revenue, costs, savings, and investments. A budget functions as a roadmap for financial decision-making and aids individuals and businesses track their economic progress.

Alongside budgeting, it is vital to establish an emergency fund to cover unexpected expenditures or monetary obstacles. Typically, economists suggest saving 3 to six months' worth of living expenses in a quickly obtainable account. This fund gives a safety internet during difficult times and stops people from entering into financial debt to deal with emergencies.

Additionally, taking care of financial debt plays a significant role in solidifying economic structures. Wyoming Credit Unions. It is necessary to keep financial obligation degrees workable and work in the direction of repaying high-interest debts as quickly as possible. By reducing financial debt, organizations and people can maximize a lot more resources for conserving and investing, inevitably reinforcing their monetary placement for the future

Conclusion

Finally, credit unions play an important function in advertising economic success via their distinct advantages, consisting of competitive prices, customized solutions, community assistance, and financial education and Bonuses learning. By focusing on participant Get More Information satisfaction and proactively engaging with neighborhood neighborhoods, lending institution help people and companies alike develop a strong financial structure for long-term success and security. Signing up with a cooperative credit union can be a critical decision for those seeking to achieve monetary success.

This dedication to member solution can result in customized economic services, such as tailored car loan alternatives or economic education and learning programs, to help members attain their financial goals.

A budget plan serves as a roadmap for economic decision-making and aids individuals and businesses track their monetary development.

In conclusion, debt unions play a vital role in promoting financial success via their distinct advantages, including affordable rates, customized solutions, community assistance, and economic education and learning.

Report this page